Navigating the ever-changing landscape of mortgage rates can seem like a complex endeavor, especially if you're in the market for a new home in South Florida. In recent years, we've seen rates plummet to unprecedented lows, surge sharply, and now, they're beginning to stabilize somewhat. But what drives these fluctuations?

The dynamics behind mortgage rates are multifaceted, involving several key factors. Let's delve into some of the primary influences on these rates.

Inflation and the Federal Reserve's Influence

While the Federal Reserve (the Fed) doesn't set mortgage rates directly, its monetary policy decisions, particularly adjustments to the Federal Funds Rate, play a significant role. These adjustments are made in response to inflation trends, economic growth, and employment data, among other indicators. The relationship between the Fed's actions and mortgage rates isn't straightforward, but there's a noticeable correlation. Business Insider sheds light on this, noting:

"The Federal Reserve combats inflation by modifying the federal funds rate, indirectly affecting mortgage rates. Rising inflation and the anticipation of further Fed rate hikes can elevate mortgage rates. Conversely, if the market expects the Fed to reduce rates amid slowing inflation, mortgage rates often decline."

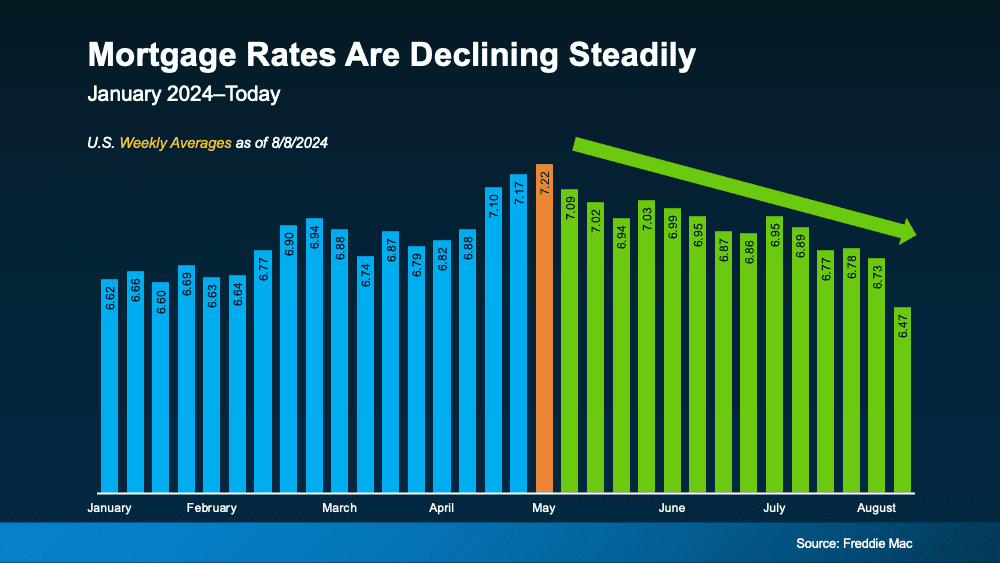

Recent actions by the Fed to increase the Federal Fund Rate in an effort to curb inflation have led to a spike in mortgage rates. However, there's optimism that both inflation and mortgage rates will become more favorable throughout the year. Danielle Hale, Chief Economist at Realtor.com, suggests:

"Mortgage rates are expected to decrease in 2024 as inflation conditions improve."

There's also speculation about a potential cut in the Fed Funds Rate due to cooling inflation, which remains above the Fed's preferred level.

The 10-Year Treasury Yield's Role

Mortgage lenders often reference the 10-Year Treasury Yield when setting interest rates for home loans. A rise in the yield typically results in higher mortgage rates, and vice versa. Investopedia explains:

"Mortgage lenders frequently align their interest rates with the yield on the 10-year Treasury bond."

Though the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has historically been stable, recent deviations suggest mortgage rates may have room to decrease. Monitoring the treasury yield can provide insights into future mortgage rate trends. Closing Thoughts

With a critical Fed meeting on the horizon, industry professionals are keenly watching for decisions that could influence the broader economy and mortgage rates. For those navigating the real estate market, especially in vibrant communities from Miami Beach to Coral Gables, it's crucial to have a knowledgeable team by your side. As your dedicated real estate agent in Miami, I'm here to help you understand these changes and how they might impact your home buying journey.