Knowing When to Buy a Home: Financial Insights for Future Homeowners

Buying a home in Miami is a significant milestone, but it's essential to recognize that it's not always the right time for everyone. A home purchase is a long-term investment, and making this decision without proper financial planning can lead to significant stress. For more insights on the long-term benefits of real estate investment, check out our blog from last week.

The truth is, knowing when not to buy a home is just as crucial as knowing when to buy. Whether you're a first-time buyer or looking to move, understanding your financial situation is key to making a wise decision. Let’s start by looking at what recent home buyers are experiencing in today’s market.

Causes of Financial Stress for Today’s Home Buyers

According to a recent survey from Clever, 43% of homeowners who bought in 2023 or 2024 have struggled to meet their monthly mortgage payments. This financial strain is due to several key factors:

- 37% of buyers purchased a home that exceeded their initial budget.

- 44% of new homeowners have taken on extra debt outside of their mortgage to maintain their lifestyle.

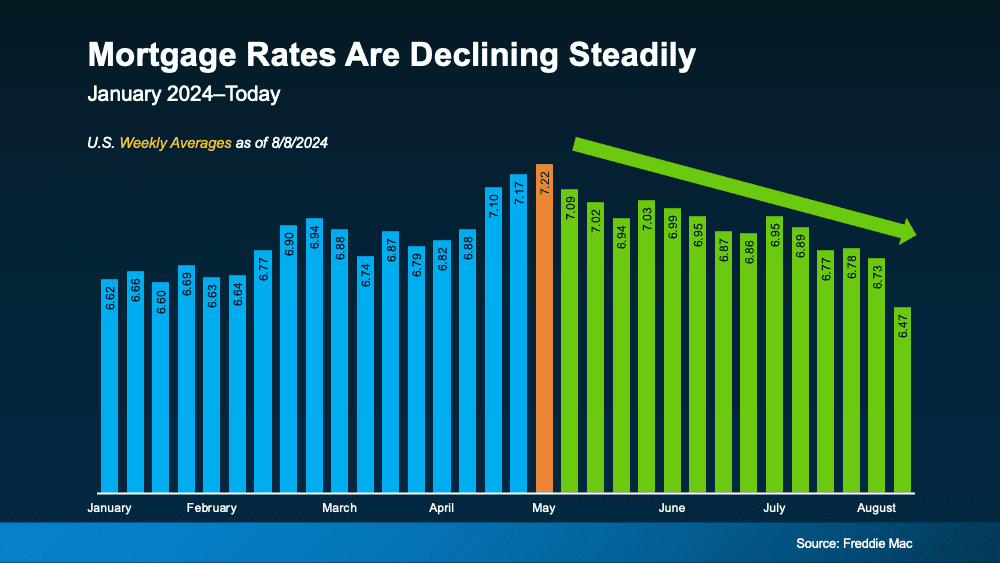

- 50% accepted a higher interest rate than planned. (Note: This is why it’s important to base your budget on a monthly payment, not the purchase price of the house—but more on that later.)

All of these factors lead to financial stress and regret—and that’s the last thing new homeowners need to deal with. To help avoid these pitfalls, let’s discuss some key financial tips you need to consider before taking the plunge.

4 Key Financial Tips to Consider

-

Assess and Plan Your Budget

Setting a realistic budget is the cornerstone of a successful home-buying experience. However, you can’t just think about the purchase price of the home. Factor in all potential expenses that will impact your monthly budget. Include costs such as property taxes, insurance, HOA fees, and unexpected repairs. You’ll also want to leave a little wiggle room for fluctuating mortgage rates. Knowing what you can comfortably afford in monthly payments rather than the total purchase price will set you up for success.

Additionally, don’t forget about the upfront costs associated with buying a home. These include the down payment, closing costs, home inspections, and moving expenses. Saving for these costs is crucial to avoid dipping into emergency funds or taking on extra debt. Planning ahead for these expenses ensures you can cover them without compromising your financial stability.

-

Minimize Additional Debt

Aim to avoid taking on extra debt before, during, and immediately after your home purchase. Keeping your finances in check will help you manage your mortgage payments more comfortably. Once you have been making regular payments for several months, you can reassess your finances and make adjustments to your budget where needed.

-

Monitor and Improve Your Credit

In Q1 2024, the median credit scores for mortgages remained flat at 770 and auto loans were at a record high of 724, according to the New York Fed. This means banks aren’t just giving away mortgage loans like pre-2008 (which is a good thing!). It also means that maintaining good credit is essential for favorable loan terms. Regularly check your credit report and address any discrepancies.

-

Plan for the Future

Think about your long-term financial goals and how buying a home fits into them. Are you planning to stay in the home for several years, or is this a short-term move? Your plans will impact how you manage your finances—as well as your decision to buy. Ensure your home purchase aligns with your broader financial objectives to avoid future regrets.

In addition, having an emergency fund is vital for future financial stability. Ensure you have enough savings to cover at least three to six months of expenses. This safety net provides peace of mind and financial security if unexpected costs arise, helping you avoid financial stress.

Knowing When NOT to Buy

So, when should you consider holding off on buying a home? Here are some signs:

- High Debt Levels: If your debt-to-income ratio is high, adding a mortgage might strain your finances.

- Unstable Income: If your job situation is uncertain, it might be wise to wait until your income is more stable.

- Lack of Savings: Ensure you have enough savings not just for the down payment, but also for emergencies and ongoing maintenance.

- Uncertain Plans: If you may be moving in the near future, purchasing a home may not be the best option.

Recognizing these signs and being honest about your financial situation can save you from potential stress and regret. By taking the time to assess your readiness and plan carefully, you’ll be in a stronger position to make a successful and satisfying home purchase when the time is right. Remember, waiting until you’re financially prepared isn’t a step back—it’s a smart step towards a more secure and enjoyable homeownership journey.