Everywhere you turn, conversations revolve around the possibility of an upcoming recession. If you're in the process of buying or selling a house, you may be concerned about the wisdom of your plans. However, take solace in the fact that experts predict any recession will be mild and short-lived. The Federal Reserve's March meeting projected a recovery within two years after a mild recession beginning later this year. It's essential to remember that not every recession leads to a housing crisis. In this article, we delve into historical data to demonstrate that home prices don't invariably fall during economic downturns. By examining the fundamentals of the current housing market, we debunk the notion that a repeat of the 2008 crash is imminent.

Section 1: A Recession Doesn't Mean Falling Home Prices To dispel the misconception that home prices decline during recessions, let's examine historical data. By studying recessions dating back to 1980, we find that home prices appreciated in four out of the last six downturns. Contrary to popular belief, an economic slowdown does not guarantee a decrease in home values. While certain areas may experience slight declines or gains, a market crash akin to the 2008 housing crisis is unlikely. The housing market today is fundamentally different, with a low inventory of homes for sale. This contrasting scenario reduces the possibility of a crash and instills confidence in the market's stability.

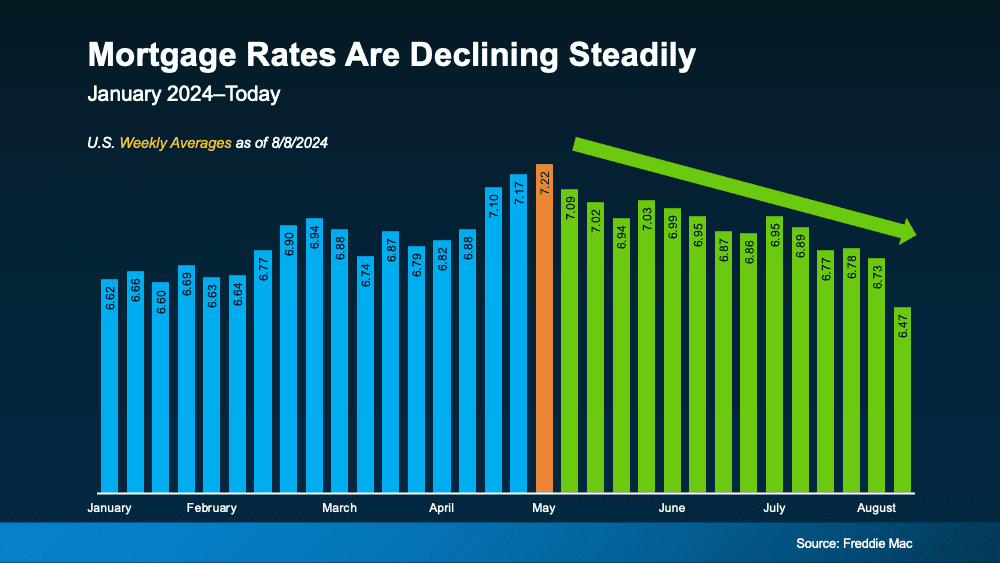

Section 2: A Recession Means Falling Mortgage Rates Rather than spelling doom for the housing market, a recession often leads to falling mortgage rates. Historical data reveals a consistent pattern of decreasing mortgage rates during economic slowdowns. As the economy faces a traditional recession, the Federal Reserve typically lowers interest rates. This action stimulates spending and offers more affordable mortgage rates, presenting increased opportunities for homebuyers. While mortgage rates have recently experienced volatility in response to high inflation, a recession can still bring rates below their current thresholds, providing favorable conditions for prospective homebuyers.

Take control of your housing decisions without fear of a recession's impact. Moreover, history has shown that during economic downturns, mortgage rates tend to decrease. Seize this opportunity to work with Anthony Spitaleri and his experienced team to explore the housing market with confidence, knowing that a recession can bring favorable conditions. Don't hesitate to make informed decisions about your home and take advantage of potentially lower mortgage rates in the face of economic challenges. Contact us today to schedule your free consultation and discover how Anthony Spitaleri and his team can help you navigate the housing market during these times of opportunity.