Have you ever wondered about the intriguing connection between inflation and the housing market? Surprisingly, they are interlinked, and changes in one invariably affect the other. Here's a simplified overview of how these two dynamics interact.

Understanding the Nexus: Housing Inflation and Overall Inflation

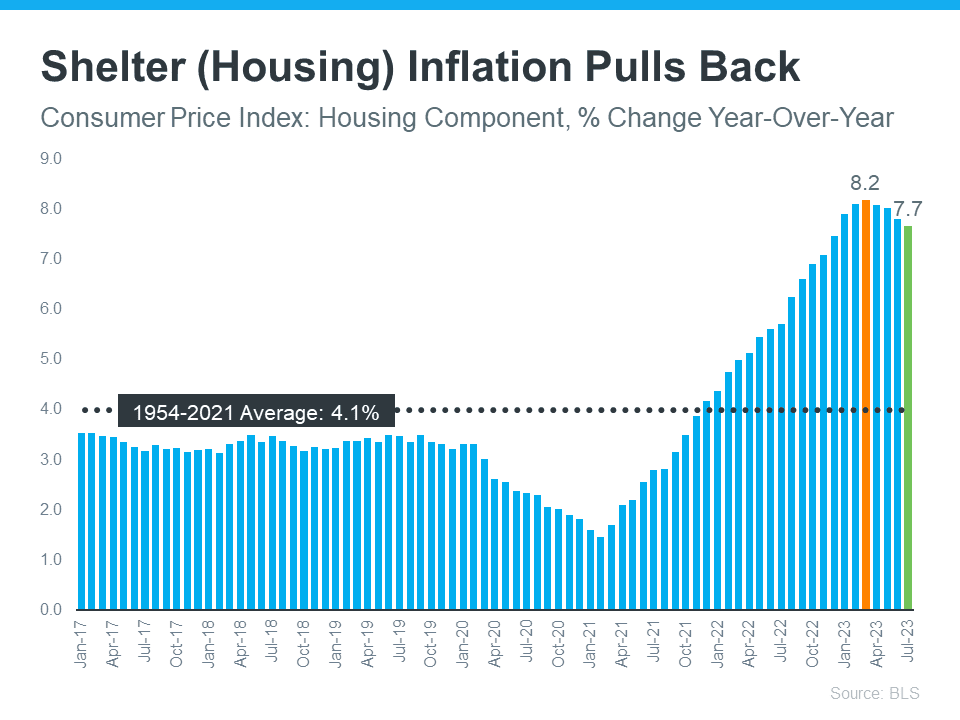

Shelter inflation, a metric tracking price growth in the housing sector, is derived from a survey conducted by the Bureau of Labor Statistics (BLS). This survey collects data from both renters and homeowners, asking renters about their monthly rent payments and homeowners about the hypothetical rental value of their homes if they weren't residing in them.

Similar to how overall inflation gauges the cost of everyday items, shelter inflation assesses the cost of housing. In recent months, based on this survey, shelter inflation has experienced a gradual decline (refer to the graph below):

Why is this significant? Shelter inflation contributes to approximately one-third of overall inflation, as measured by the Consumer Price Index (CPI). Consequently, shifts in shelter inflation translate into observable fluctuations in overall inflation. Therefore, the recent dip in shelter inflation may hint at a potential reduction in overall inflation in the upcoming months.

Such moderation would be a favorable development for the Federal Reserve (the Fed), which has been diligently working to manage inflation since early 2022. Although they have made progress (inflation peaked at 8.9% last year), they are still striving to attain their 2% target (the most recent report cites a rate of 3.3%).

Inflation and the Federal Funds Rate: A Delicate Balance

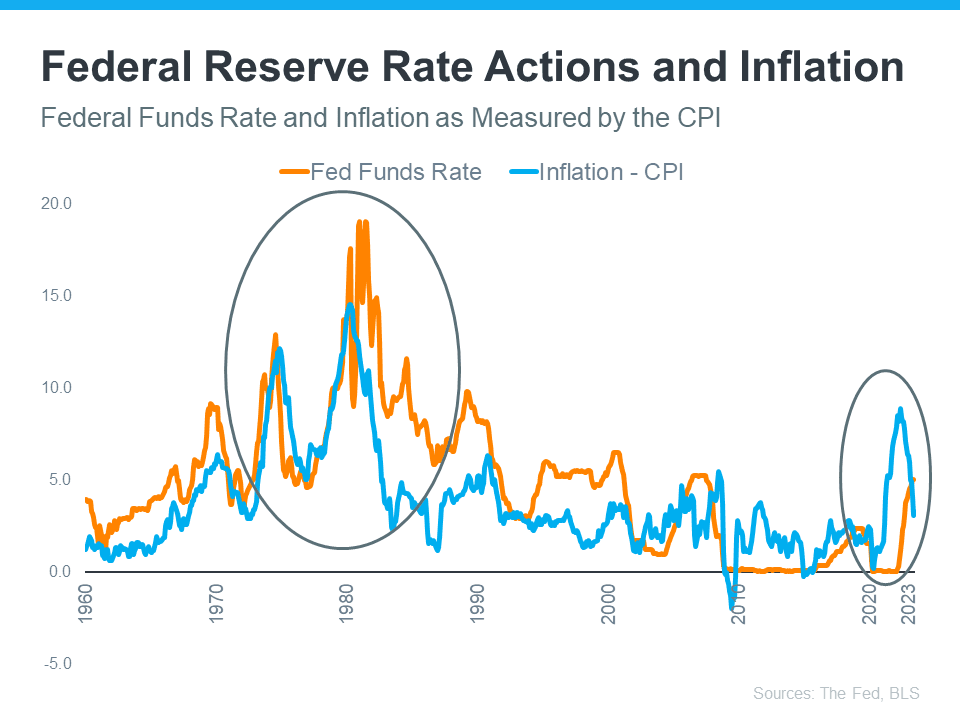

How has the Fed been addressing inflation concerns? They have been increasing the Federal Funds Rate, an interest rate that influences interbank borrowing costs. To prevent the economy from overheating as inflation surged, the Fed responded by raising the Federal Funds Rate.

The graph below illustrates the correlation between inflation (depicted by the blue line) and the Fed's adjustments to the Federal Funds Rate (represented by the orange line) to restore it to their 2% target (see graph below):

The circled portion of the graph illustrates the most recent inflation spike, the Fed's corresponding actions to elevate the Federal Funds Rate, and the subsequent moderation of inflation in response to these measures. As inflation approaches the Fed's 2% goal, the need for further increases in the Federal Funds Rate may diminish.

A Glimpse into Mortgage Rate Possibilities

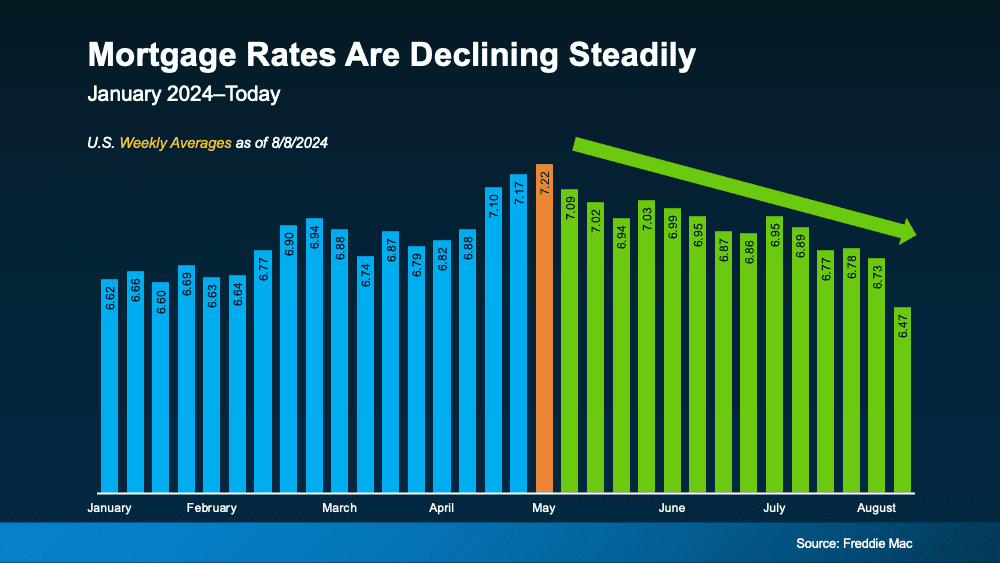

So, how does all of this impact you? While the Fed's actions do not directly dictate mortgage rates, they exert an influence. As Mortgage Professional America (MPA) clarifies: ". . . mortgage rates and inflation are connected, however indirectly. When inflation surges, mortgage rates rise to keep pace with the value of the US dollar. Conversely, when inflation eases, mortgage rates tend to follow suit."

While predicting the future of mortgage rates remains uncertain, there is optimism in observing signs of inflation moderation within the economy.

In Summary

Whether you're considering buying, selling, or simply staying well-informed about the housing market, don't hesitate to reach out. Connect with us to explore how these intricate economic dynamics may affect your real estate endeavors.