In a typical housing market, comparing real estate metrics between different years can be challenging. The market's inherent variability makes such comparisons less meaningful or accurate. Unforeseen events can significantly impact the circumstances and outcomes being evaluated.

Attempting to compare this year's numbers to the exceptional 'unicorn' years we recently witnessed is nearly futile. By referring to 'unicorn,' we employ a less common definition of the term: something greatly desired but difficult or impossible to find. The real estate landscape underwent profound changes in the past few years due to the pandemic. The desire for homeownership soared as people sought homes with office spaces and spacious backyards. Waves of first-time and second-home buyers entered the market. Mortgage rates, which were already low, dropped to historic lows. The forbearance plan all but eliminated foreclosures. Home values experienced unprecedented levels of appreciation. It was a market that had always been "greatly desired but difficult or impossible to find" – a 'unicorn' year.

However, things are now returning to normal, and the 'unicorns' have disappeared from the scene. Comparing today's market to those extraordinary years lacks coherence. Here are three examples to illustrate this point:

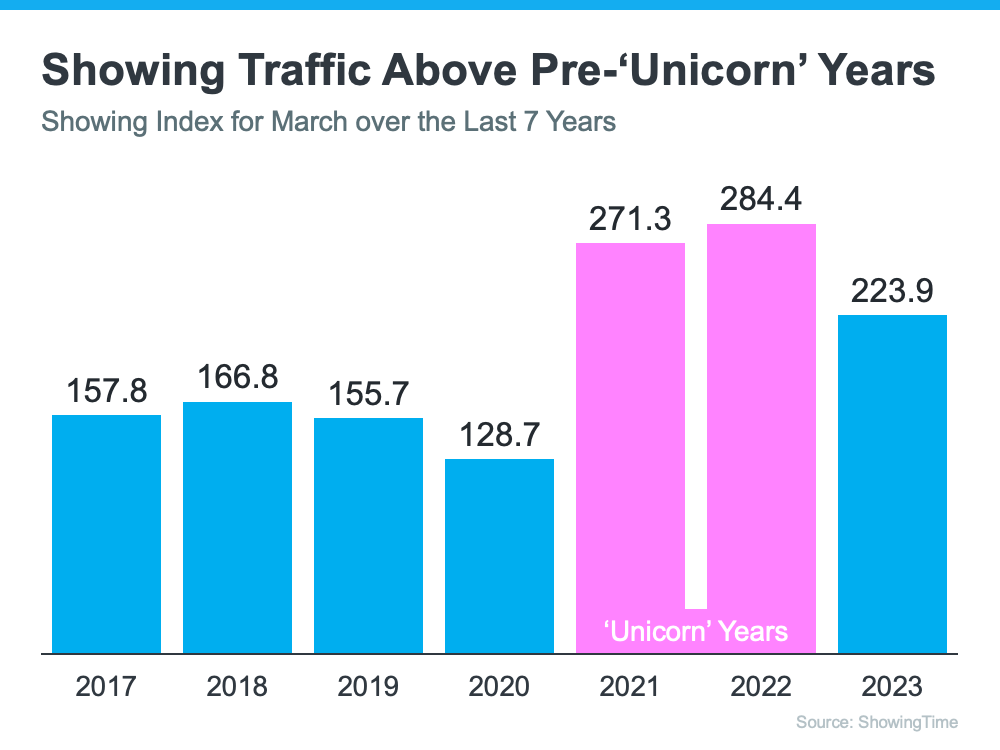

- Buyer Demand: Though headlines might suggest a dearth of buyers, the reality is that we still sell over 10,000 houses daily in the United States. Naturally, buyer demand has declined compared to the 'unicorn' years. However, when we compare it to normal years (2017-2019) using data from ShowingTime, we can observe that buyer activity remains robust. (See graph below for reference.)

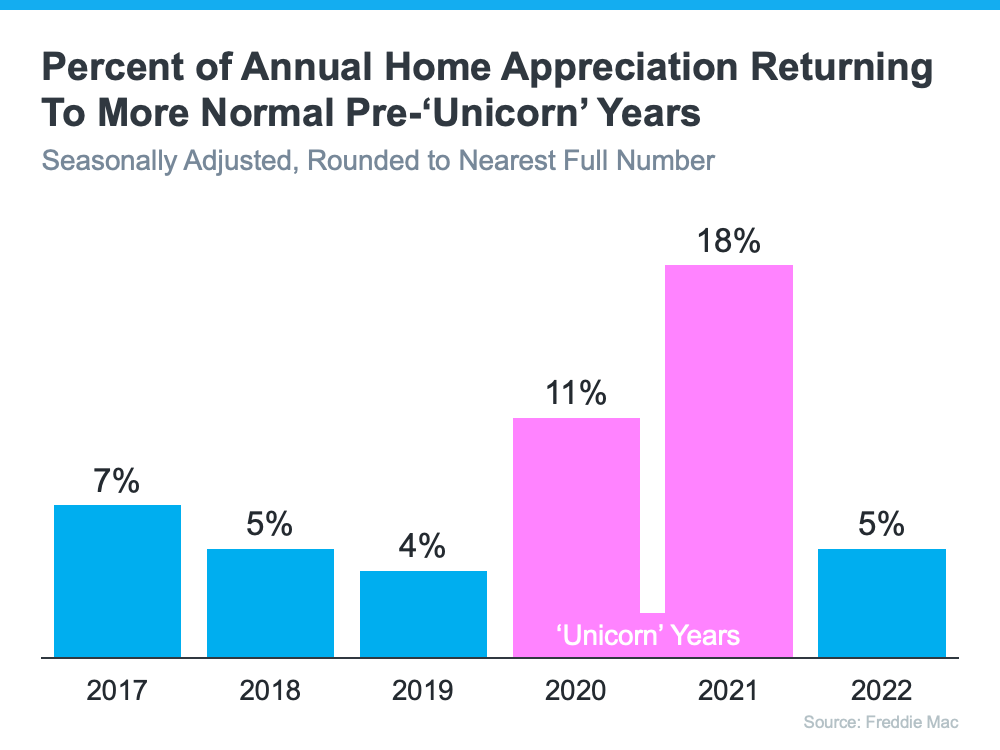

- Home Prices: Attempting to compare today's home price increases to those of the past couple of years is misleading. According to Freddie Mac, both 2020 and 2021 witnessed historic appreciation numbers. To provide a more accurate perspective, the graph below also illustrates the home price trends during the more typical years of 2017-2019.

The graph reveals a return to more normal home value increases. The latter half of 2022 experienced several months of minimal depreciation. However, Fannie Mae reports that the market has now returned to more customary appreciation rates in the first quarter of this year.

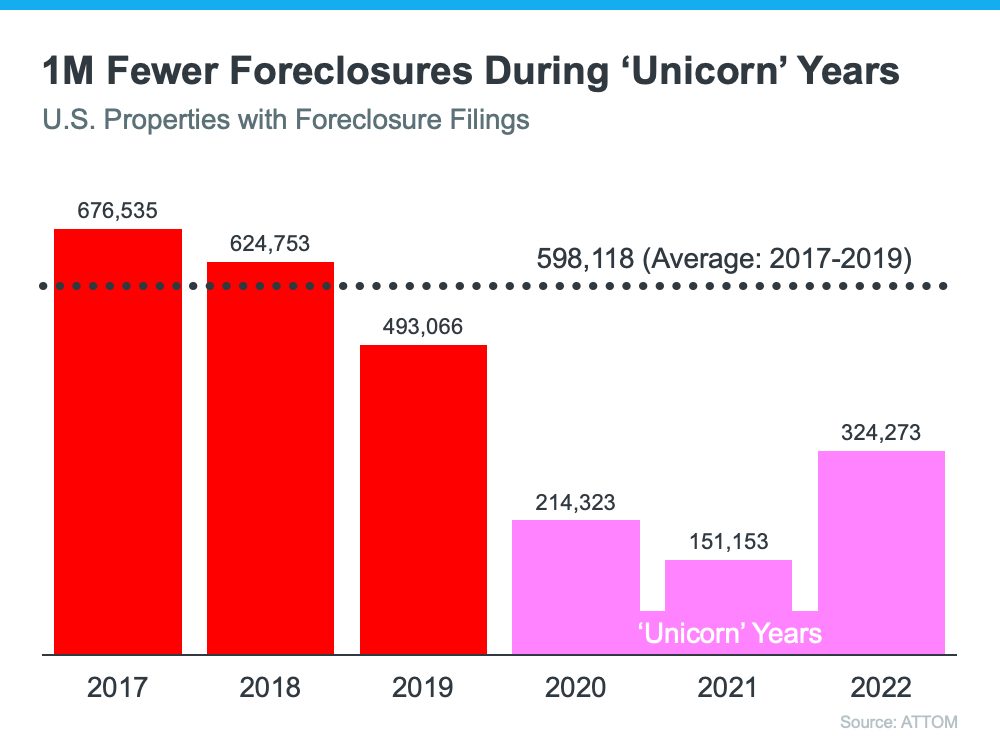

- Foreclosures: Alarming headlines about significant percentage increases in foreclosure filings have surfaced. However, these percentages represent increases over historically low foreclosure rates. The following graph, sourced from ATTOM (a property data provider), provides further information:

With the moratorium on foreclosures coming to an end, there will inevitably be an upswing in foreclosure numbers compared to the last three years. Every year, there are homeowners who tragically lose their homes to foreclosure, and their plight is disheartening. Nevertheless, when we contextualize the current numbers, we realize that they are returning to the normal filing rates observed from 2017-2019.

Amidst the unsettling headlines surrounding the housing market this year, it's important to have Anthony Spitaleri and his team on your side. With their expertise, they can help you cut through the noise and make sense of it all. By providing the right perspective and guidance, they ensure you can make informed decisions without being swayed by inappropriate comparisons to the 'unicorn' years. Connect with them today to find clarity and peace of mind in navigating the housing market.